20+ Sc Paycheck Calculator

This South Carolina hourly. Important Note on Calculator.

South Carolina Payroll Paycheck Calculator South Carolina Payroll Taxes Payroll Services Sc Salary Calculator

Easy 247 Online Access.

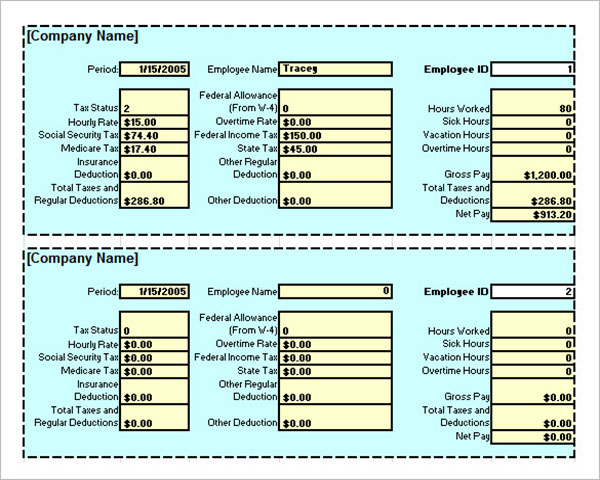

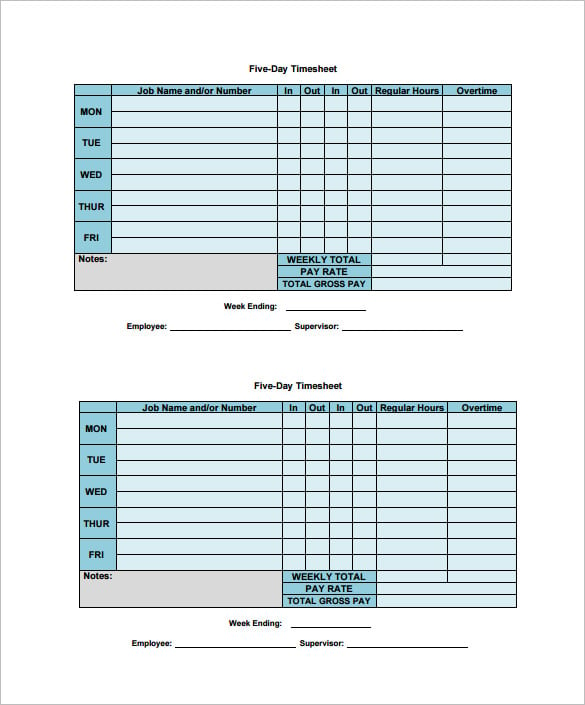

. 2023 Withholding Tax Tables 2023 SC Withholding Tables 2023 SC. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. One of the most useful and sought after this paycheck calculator quantifies take-home pay for salaried employees.

No monthly service fees. In South Carolina the filing requirements depend on your age filing status and residency status. South Carolina Payroll Calculator We designed a handy payroll tax calculator to help you with all of your payroll needs.

Free calculator to find the actual paycheck amount taken home after taxes and deductions from salary or to learn more about income tax in the US. Calculate your South Carolina net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free South. It is not a substitute for the.

No api key found. South Carolina Withholding tables were updated for the first time in 25 years in 2017. The South Carolina Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2023 and.

The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for South Carolina residents only. Salary Paycheck Calculator South Carolina Paycheck Calculator Use ADPs South Carolina Paycheck Calculator to estimate net or take home pay for either hourly or salaried. Do you want to get more for your business with Payroll Benefits HR made easy.

Ready for a live demo. Fill out our contact form or call 877 729-2661 to speak with Netchex sales and. If youre a new employer youll pay 055.

For 2022 the South Carolina unemployment tax applies to the first 14000 of each employees pay and rates range from 006 to 546. Resident taxpayers under 65. By accurately inputting federal withholdings allowances and any relevant.

Do I Have to Pay Income Tax in South Carolina. Benefits to retired unemployed or. Open an Account Earn 14x the National Average.

For a married couple with a combined annual income of 102000 it is 8069390. Tables are now updated annually. The take home pay after taxes for a single filer who earns 51000 per annual is 4061940.

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide. All you need to do is enter wage and W-4 information.

Salary Paycheck Calculator Calculate Net Income Adp

Esmart Paycheck Calculator Free Payroll Tax Calculator 2023

12 Salary Paycheck Calculator Templates Free Pdf Doc Excel Formats

Us Paycheck Calculator Queryaide

How To Calculate Severance Pay 7 Steps With Pictures Wikihow

How To Calculate The Kinetic Energy Of Electrons Quora

South Carolina Hourly Paycheck Calculator Gusto

Free Paycheck Calculator Hourly Salary Usa Dremployee

Salary Paycheck Calculator Calculate Net Income Adp

8 Salary Paycheck Calculator Doc Excel Pdf

The Truth About Everything Catalog Thought Wiest Brianna Amazon De Books

8 Salary Paycheck Calculator Doc Excel Pdf

Auto Captcha Solver Captchas Io Chrome Web Store

California Paycheck Calculator Smartasset

Income Calculators Pay Check Salary Wage Time Sheet

Amazon Com Numworks Graphing Calculator Office Products

7 Weekly Paycheck Calculator Doc Excel Pdf